Wednesday, November 7, 2007

What Your Auto Insurer Knows About You

10 Tips to Avoid Auto Accidents

1. Avoid drinking and driving.

2. Minimize distractions such as reading newspapers or talking on the cell phone when driving.

3. Properly maintain vehicles. Tune up cars according to maintenance schedule, and especially take note monthly of tire condition.

4. Do not encourage aggressive drivers. Let other aggressive driving behavior roll off your back, or call the police. Losing your temper could worsen the situation.

5. Leave a safe distance between your cars and others. For every 10 miles per hour of speed, leave at least one car length space between your vehicle and the vehicle ahead.

6. Maintain a constant speed. Don't continually slow down or speed up.

7. Adjust mirrors properly and check the side and rear-view mirrors every 15 seconds.

8. Take defensive driving classes to improve your ability to drive and be better prepared for the unpredictable behavior of other motorists.

9. Proceed with great caution through intersections. Intersections are the center of most accidents. When entering an intersection, look left, then right, then left again to ensure the area is clear.

10. Be sufficiently aware of road conditions and be more visible. Keep your lights on at dusk and dawn and during rain, as is the law in most states. Understand basic vehicle dynamics, such as knowing how to recover from a skid.

Car Safety Tips for the Holiday Shopping Season

On your mark, credit cards set and go…to the nearest mall, because it is holiday shopping time. That's right; soon millions of consumers will be flooding the malls in search of the perfect gifts for everyone on their shopping list. But before you hop in your car and drive to the nearest mall, you may want to check out our Holiday Shopping Car Safety Tips - it just might make the difference between a happy holiday season and a disastrous one.

Holiday Mall Parking Lot

Many things can happen to your vehicle in a mall parking lot while you are inside happily holiday shopping away. For instance, your car can get damaged by opening doors, rolling shopping carts or testy drivers trying to fit into tight parking spots. While this may seem like the price your car has to pay for trying to go to the mall during the holidays - it doesn't have to be. There are many things you can do to help keep you and your car safe while at the mall this holiday season.

Popular Shopping Malls

After work and weekends are the most popular times for people to go holiday shopping. With that being said, consider shopping during the day or before noon on weekends. This will not only help you avoid over crowded mall parking lots, it will also help you to get in and out of stores quickly!

In addition, avoid going to popular malls in your area during peak shopping hours. This will help reduce the amount of cars and people you have to dodge and help keep your car safe from potential theft and damage. To help identify the most popular malls in your area, we have listed the Top 10 Largest Shopping Malls in the United States - so you can avoid what could potentially turn into a holiday shopping nightmare.

Largest Shopping Malls in the United States

South Coast Plaza, Orange County, CA

King of Prussia Mall, Philadelphia, PA

Sawgrass Mills, Ft. Lauderdale, FL

Del Amo Fashion Cetner, Los Angeles, CA

Mall of America, Minneapolis-St Paul, MN

Grand Canyon Parkway, Las Vegas, NV

The Galleria, Houston, TX

Woodfield Mall, Chicago, IL

Plaza Las Americas, San Juan, PR

Roosevelt Field Mall, New York, NY

Stay Safe During The Holiday Season

No matter when or where you go holiday shopping, safety should always be your first priority - especially when it comes to your car. That's because mall and shopping center parking lots are prime targets for car theft, car vandalism and robberies.

To help prevent this from happening to you, Insurance.com has provided some helpful Holiday Shopping Safety Tips to keep you and your car safe and secure during the holiday season.

Holiday Shopping and Driving Safety Tips

Always park in a spot where there is plenty of light and if possible, park close to your destination.

Avoid parking next to vans, trucks with camper shells, or cars with tinted windows. Close all windows and lock all doors.

Take note of where you parked your car and what store entrance it is closest to.

Shop with a friend or family member - having a friend walk to and from the parking lot with you will help keep you both safe and sound.

Place your packages in your trunk or under your seat where no one can see them.

Condense your packages into one or two bags to create the illusion that you did not purchase so many valuable (and theft-worthy) items.

If you run out to your car to drop off packages while shopping, make sure to move your car to a new location before heading back into the mall. This will help lead anyone that is watching you to believe that you and your packages have headed home for the night.

Leave your most expensive purchases until the end of the day when you can quickly hop in your car and go directly home.

Request for a security guard to escort to your car.

When walking to your car have your head up and your keys ready, the last thing you want to do is appear vulnerable to criminals. In addition, make sure to look under and in front of your car to make sure that no one is waiting to attack you.

Do not approach your car alone if there are suspicious people in the area.

Be aware of your surroundings. Often thieves will disguise themselves as normal shoppers who accidentally bump into you stealing your purse, wallet, packages, car keys or even worse, attacking you.

When entering your car, make sure to check your front seat and back seat for anyone that could potentially be hiding in the car.

Get into the car, lock the doors and exit the area immediately. Criminals prey on shoppers who sit in their cars to make phone calls or review their purchases for the day. Don't leave yourself susceptible to such a risk.

What Your Auto Insurance Coverage Won't Cover

Through the course of a shopping day, many people will take packages to and from their car to lessen the load while they are walking through the mall. Even though this may seem like a great idea at the time, it is not if the gifts are stolen from your car. That's because many auto insurance company will not cover holiday packages stolen from a policy holder's car - even if they were securely stored in your trunk. However, if you paid for your gifts with a credit card you might be in luck! Some credit card companies will cover stolen purchases if they were paid for with their credit card, but if you paid with cash or check, you are out of luck.

Regardless of how you paid for your gifts, you should always file a police report to help alert police of the incident and to potentially prevent this crime from happening to someone else.

Upgrade or change Your Auto Insurance

If your auto insurance policy does not cover stolen property from your vehicle and you would like to find an auto insurance company that does, log on to Insurance.com's auto insurance comparison application. Here, you will be able to evaluate multiple rates from best-in-class insurance providers - helping you find the best auto insurance coverage for you and your holiday shopping needs.

Car Safety: Side Impact Crash Test Results

The Insurance Institute for Highway Safety, Sunday, released results of their Side Impact Crash Test. The results showed that 14 of the 16 cars tested earned a rating of "poor," the lowest of four ratings. Only the Chevrolet Cobalt and Toyota Corolla, when equipped with optional head-protecting side airbags, received ratings of "Acceptable," the second-highest rating on the Institute's four-point scale. See below for a complete list of Side Impact Crash Test results.

The institute's test reproduces a severe auto crash. A barrier designed to simulate the front of a sport-utility vehicle or pick-up truck hits the side of the vehicle at 31 mph. A "poor" rating means a high chance of serious injury in a similar crash.

According to the IIHS, 51 percent of driver deaths in recent model cars during 2000-01 occurred during side impact crashes, up 40 percent since 1980-81. Underscoring the importance of this research, almost 60 percent of the driver deaths in the cars struck on the driver side were hit by SUVs or pickups - up from about 30 percent during 1980-81

The Insurance Institute for Highway Safety is an independent, nonprofit organization supported by auto insurance companies. The IIHS conducts scientific research and educational programs designed to reduce deaths, injuries, and property damage resulting from crashes on the nation's highways.

Vehicle safety data is a key factor used by insurance companies to determine auto insurance rates. This data, combined with coverage choices and personal factors such as age, gender and driving record, determines what you pay for your auto insurance . Since different insurance companies weigh these factors differently, auto insurance rates can vary significantly from carrier to carrier for the exact same coverage. To make the best decision on auto insurance, consumers are encouraged to shop around and compare side-by-side rates from several companies.

Study Shows Cell Phone Users More Prone to Accidents

You've dialed the wrong number if you think that it's safe to drive while chatting on your cell. A newly released study of Australian motorists found that cell phone users were four times as likely to be involved in a serious crash.

First study of its kind

The study, which ran in the British Medical Journal, is the first of its type to use actual crash data and cell phone records to correlate serious vehicular accident injuries with talking on the telephone. Further, the results show that the same risks are posed whether holding a phone to your ear or talking through a hands-free devise such as a speakerphone.

You'd be hard-pressed to find a similar study in the U.S. because cell phone records aren't considered public information. The new study looked at cell phone records of some 500 drivers who had accidents in Perth, where drivers cannot use hand-held phones. Researchers estimated the time of the crash and examined whether the motorist used a cell phone in the minutes leading up to the accident. They then looked at similar time intervals in the days before the crash to determine the added risk of using the cell phone.

Talking, not holding, is more distracting

The study was conducted by the Insurance Institute for Highway Safety (IIHS), a nonprofit research organization in Virginia. IIHS dispatched researchers to three Perth hospitals for interviews of crash victims in years 2002 to 2004. Among other things, accident victims were asked whether they had hands-free phone devices in the vehicle and how frequently that equipment was used. The IIHS research in Australia found that the most distracting cell phone activity is the act of conversing on the phone, not the holding of equipment.

Consistency across groups of drivers

"The main finding of a fourfold increase in injury crash risk was consistent across groups of drivers," says Anne McCartt, IIHS vice president for research and an author of the study. "Male and female drivers experienced about the same increase in risk from using a phone. So did drivers older and younger than 30 and drivers using hand-held and hands-free phones."

McCartt's IIHS colleague Russ Rader contends, "it doesn't matter whether you're using a hand-held phone or hands-free equipment, the danger's ever present. This study clearly shows that drivers should not be using cell phones when driving. The research shows that the risk is significant. If you're on a cell phone when driving, you're putting yourself and your passengers at risk, and you're endangering the lives of other motorists. "

Need to use your cell when driving?

According to Mr. Rader, if you need to use your phone when driving, "Pull off to the side of the road and make your call or wait until you get to your destination." Rader warns motorists to avoid multi-tasking when behind the wheel. "Driving safely requires total concentration. Driving is a complex task. Keeping track of what's going on around you is difficult enough without distractions."

Undoubtedly, numerous drivers use cell phones, a fact of driving life that isn't lost on Rader. "The idea of not using your cell phone may be hard for some people to swallow, because cell phone use is ubiquitous," he added. "However, the research shows that cell phone use is a hazard to highway safety. Motorists have to ask themselves, is making this phone call worth the risk?"

Inattentive driving also is a subject of concern to the National Highway Traffic Safety Administration, in Washington, D.C. Says NHTSA spokesman Eric Bolton: "For years, we've been very concerned about inattentive driving. Cell phone use is one of many such distractions that may be a factor involved in fatal vehicular crashes." Bolton cited other major distractions, namely drivers fiddling with CDs, switching channels on the car radio, talking to passengers, eating food or drinking coffee, and looking back at children in the backseat.

"The primary job of any driver is to safely operate their vehicle without being inattentive, distracted or drowsy -- that's job one," asserted Bolton. In terms of cell phone use, Bolton continued, "we see the benefits of having the device available in an emergency, but it shouldn't be used indiscriminately. It doesn't matter whether it's hands-held or hands free, it's still a distraction that must be used responsibly by drivers."

The American Insurance Association identifies a message from the IIHS study. AIA's Nicole Mahrt pointed out that "drivers need to concentrate on the task at hand. They shouldn't be engaged in other activities such as holding the dog, talking on the cell phone, reading a newspaper or any other activity that distracts a motorist from his or her primary objective of getting to the destination safely. Such distractions tend to slow down driver reaction time to roadway hazards that can come up quickly and unexpectedly. People need to be responsible behind the wheel."

Insuring a Teen Driver in Single-Parent Households

Insuring a teenage driver is an expensive proposition. If your teen is away at college, lives part of the time with an ex-spouse, or spends a significant amount of time away from home for any other reason, are you still required to buy auto insurance for the teen? You might, depending on the circumstances and the practices of your insurance company.

When parents are divorced

When teens split time between divorced parents, which parent should include the teen on his or her auto coverage? Many companies suggest the parent, who has custody of the teen the most, should add the child to his or her policy. In some cases, insurers say it's whichever parent has custody of the teen when the child is attending school.

If the same company insures both parents, the teen will be covered by both parents' policies, regardless of whether the teen is listed as a driver on either policy. That's because some insurance policies define "an insured" as "a person related to you by blood, marriage, or adoption who is a resident of your household."

Not all policies are the same. Check your policy language or contact your insurance company for details.

Honesty is the best policy

If you don't list your teen on your policy, be prepared for the potential consequences. Cancellation, non-renewal, and surcharges are among the unpleasantries you might face.

Some insurance companies will cancel your policy for misrepresentation, if you fail to list your teen driver during the application process, or when the teen gets a driver's license.

Some insurers require all drivers be named on both policies, no matter how much time they spend in a household. If your teen has access to your car and drives it even occasionally, you might be required to list the teen on your auto policy.

The absolute worst case

In a state that allows insurers to void policies for misrepresentation, not listing your teen on your auto policy can be a costly mistake. If your teen has an accident and you file a claim, your insurer could void your policy because you failed to tell them about your teen.

If you're unsure whether your child is adequately covered, contact your agent or insurance company.

Why auto insurers are so concerned about teens

The Insurance Information Institute (III) has released statistics, showing just how much of a risk teenage drivers are to themselves and to others on the road.

In 2001, 3,608 teenage drivers were killed in traffic accidents. Teens accounted for 14 percent of all the drivers involved in motor vehicles fatalities, according to the National Highway Traffic Safety Administration.

The crash rate for teens aged 16 and 17 is three times greater than for 18 and 19 year olds. The cost of auto insurance for teenagers is always higher than for other drivers because as a group, they pose a higher risk of accidents than more experienced drivers. III warns parents adding a teenager to an insurance policy usually means a 50 to100 percent increase in the parent's insurance premium.

A discount offered by most insurance companies can help reduce the cost of insuring teen drivers. "Good student discounts" are available to teens, who have a grade point average of a B or higher.

Tips for First Time Insurance Buyers

When you buy insurance, you're really buying something that you hope you'll never have to use. But if you ever do need to file an insurance claim, you'll understand why having the right amount and right types of coverage is important.

Decide how much insurance you need

You can't stop bad things from happening. But you can protect yourself financially by purchasing insurance. How much insurance you need depends on a lot of factors including how much you owe and own, how much your assets are worth, whether you have dependents, and how much out-of-pocket cost you could afford to bear. You can estimate your coverage needs using calculators or worksheets available on-line, but it's a good idea to sit down with an insurance agent or broker who can thoroughly evaluate your needs.

Comparison shop

No matter what type of insurance you're buying, the process is essentially the same. Once you've decided what type of insurance and how much coverage you need, you can begin contacting insurance companies online, directly by phone, or through an insurance agent or broker to obtain quotes. Get quotes from several different insurers because premium cost can vary widely.

But compare the coverage offered, too. A policy might cost less because it offers fewer, or different, features and benefits. And make sure the company you've settled on is reputable, with good customer service and claims-paying ability. All insurance companies are rated by major rating agencies (e.g. Standard & Poor's, Moody's, A.M. Best) on their ability to pay claims. You can access these ratings online, through public libraries, or through car insurance company literature.

Understand what you're buying

An insurance policy is a legal contract that may be loaded with technical terms that are hard to understand. But read it anyway before you sign on the dotted line to find out about the coverage you're buying. For instance, the policy will tell you:

Who or what is covered

What coverage exclusions and limitations apply

When coverage begins and ends

How much coverage is provided

How much you'll pay for coverage (the premium)

How you report a loss or file a claim

It's always a good idea to ask an insurance professional to explain any terms, conditions, or benefits that you don't understand.

Evaluate your insurance needs periodically

As your life changes, your insurance needs change, too. So every once in a while (annually, some experts suggest), review your insurance to see if you need more (or less) coverage or an additional type of coverage. Here are some times in your life when you'll definitely want to re-evaluate your insurance needs:

You're getting married or divorced

You're starting a family

You're renting an apartment

You're buying a house or a car, or making a major purchase

Your child is going off to college

You're starting a new job or becoming self-employed

You're buying or selling a business

Your income increases or decreases substantially

You're taking care of an aging parent

You're retiring

Make your insurance policies work for you by taking the time to periodically review your needs and coverages.

Auto Insurance Rates On The Rise

A recently released auto insurance study shows that rates are continuing to climb, but you can minimize your financial pain if you "shop around" for coverage.

Shop Around

Insurance prices for the same coverage can vary by hundreds of dollars, "so it pays to shop around. Get at least three quotes," urges Jeanne Salvatore, vice president of consumer affairs for the Insurance Information Institute (III) in New York.

"Use different tools to extract the best terms and conditions such as logging on to various insurance websites, phoning carriers, and talking to friends," says Janine Gibford, government affairs advocate for the Association of California Insurance Companies (ACIC), in Sacramento.

Raise deductibles

Raising the comprehensive/collision deductible "is one of the easiest ways to cut your auto insurance bill," points out Salvatore. Bumping up the deductible can save a consumer about 15% to 20% on comp/collision coverage costs. Just be sure you can afford the deductible in the event of an accident or claim.

Lower coverages on older vehicles

Gibford has a second cost-saving tip for consumers. They can save "quite a chunk of change" if they decide to drop collision and/or comprehensive coverages on their older vehicles, she says.

Make sure you can afford that new car Auto insurance costs should enter the equation when shopping for a new or used car. "The choice of car will have a lot to do with how much you'll pay for insurance," said Salvatore. "Things like the cost of repairs, the likelihood of theft, and a vehicle's overall safety record can all affect how much you pay for insurance. If you can't afford proper coverage, then you shouldn't buy that car."

Look for discounts

Salvatore noted that a number of insurers offer discounts for car features that decrease the chances of injury or theft, such as air bags, anti-lock brakes, and anti-theft devices.

Laura Toops, spokeswoman for the National Association of Independent Insurers, Des Plaines, Ill, mentioned steering wheel locking devices and car alarms that " would serve as deterrents to would-be car thieves, and most insurers will recognize that and give you a break on your insurance premium".

Having multiple cars and drivers on your policy typically provides discount opportunities as well, as can defensive driving courses and AAA membership.

Keep your driving and credit histories clean

Salvatore emphasized that safe driving records save money over the long haul. "Those with clean driving records, meaning no moving violations or history of at-fault accidents, will pay less for insurance than drivers with spotty records."

Credit scores are an important rating factor for most insurance companies. Peter Gorman of the Alliance of American Insurers talks about the role of credit scoring in insurance underwriting. Gorman cites "strong statistical evidence in numerous studies that policyholders with good credit are more likely to take care of potential problems that could lead to losses, like repairing a leaky roof or water pipe or replacing worn auto brakes before they occur and result in expensive claims." Just another reason to maintain a good credit history.

And don't forget to shop around

To fuel your drive to find the best insurance deal, be sure to shop around for the company that works best for you! There just may be another company out there that better fits your profile. Since prices can vary by hundreds of dollars, it's certainly worth your time to shop around.

Does Your Occupation Affect Your Auto Insurance Rate?

Think your occupation does not affect your auto insurance rate - think again! In 2006 Occupation Report, results show that your occupation can greatly impact your car insurance premium.

Compiled from data from their partnering auto insurance companies, Insurance.com's report shows that scientists, pilots/navigators and actors/performers/artists pay the lowest insurance rates at an average of $935.76 per year. Attorneys/lawyers/judges, executives and business owners pay the highest insurance rates at an average of $1,383.63 per year.

Why such a big difference between occupations? According to David Roush, CEO of Insurance.com, attorneys/lawyers/judges, executives and business owners have highly stressful jobs, which require them to spend more time in their cars and talk more frequently on their cell phones than the average driver. "Taking all of these factors into account, you can see why some occupations are coined as "high-risk" and typically pay more for auto insurance then others," stated Roush.

As for scientists, pilots/navigators and actors/performers/artists, Roush says that there are a number of reasons why these occupations pay less for auto insurance. For one, scientists are viewed as being very meticulous and detailed-oriented people, which translates to good driving habits on the road. This outstanding attention to detail typically means scientists are safer drivers, resulting in lower auto insurance premiums.

The same goes for pilots and navigators whose jobs require them to be focused on the safety and wellbeing of others - skills that are often transferred over to their driving habits as well. "Pilots and navigators are often very safe drivers because their driving record not only impacts their personal life, but also their professional life," noted Roush. "If a pilot or navigator was to get into an accident or receive a DUI, their career opportunities would be restricted or even worse, eliminated."

Actors, performers and artists are also at the lower end of insurance premiums because their jobs require them to work in the city, where they are more apt to commute via train or bus to work, versus driving - limiting their time in the car and reducing their chance of getting into a car accident.

However, receiving discounts on auto insurance is not a new concept. For years, insurance companies have been giving discounts to members of "affinity groups," such as AARP, AAA, alumni groups and other associations. These discounts are just now being extended to certain occupations as well, noted Roush.

Wonder if your occupation can save you money on your auto insurance? To find out, simply logon to Insurance.com's auto insurance comparison application. Here you will be able to evaluate multiple rates from best-in-class insurance providers - helping you find the best auto insurance rate and best professional discount for your budget.

What Your Auto Insurer Knows About You

When you apply for an insurance policy or submit a claim, you're probably unaware of the streams of information about you that flow to your insurance company, private businesses, and your previous insurer. Mark Twain once wrote that insurance companies are a "power behind the throne that [is] more powerful than the throne itself," but that was more than 100 years ago. Today, the true power lies in the hands of the database companies that make their money by selling information about you.

Scoring your finances

What the insurance industry calls "credit scores" are actually "insurance risk scores." Both scores are based on information contained in your full credit report, but they put weight on different factors in order to calculate a final score. Thus, even if you purchase your credit score from one of the major credit-reporting agencies, you still don't know your "insurance risk score," which is not available to you.

According to Craig Watts of Fair, Isaac & Co., a provider of scores, a regular credit score weights data in order to evaluate your use of money. But insurance scores give weight to data in order to evaluate your stability. So, if you've paid your bills in a timely manner and you've had accounts open for a long time, you would be considered more "stable" than someone who has been delinquent and opens and closes accounts frequently. Credit scores and insurance scores generally move in the same direction as your credit history changes (meaning move up or down), but there could be cases where you have credit activity that impacts one score more than the other.

If you have some unusual activity within the month before you buy auto insurance, your insurance score could be downgraded. Insurers may then consider you a bad risk (where allowed by law) and refuse to sell you a policy, or charge you a higher premium for a policy. However, if you decrease your credit activity and wait a month to purchase your insurance, you could help your chances. Remember that there are many factors that insurers use when evaluating you as an auto or home insurance customer, including your driving record (for auto insurance only), your personal claims history, and where you live.

ChoicePoint and ISO

ChoicePoint, with the help of a Fair, Isaac and Co. scoring formula, and the Insurance Services Office (ISO) offer insurers extensive nationwide resources that contain your name, address, phone number, credit report, claims history, and motor vehicle report - and that just scratches the surface. ChoicePoint also compiles aliases, criminal records, and histories of vehicles. "If you've got a car that's been in 35 accidents, that's something the insurance company is going to want to know," says Mark Wheeler, spokesperson for ChoicePoint.

ChoicePoint, which is an offshoot of the Equifax credit-reporting company, maintains a database called CLUE (Comprehensive Loss Underwriting Exchange). The company uses the information it gathers and maintains for "casualty loss" scoring, claims history reporting, and driving-record reporting. When a consumer fills out a new auto insurance application, the potential insurer queries ChoicePoint for an insurance score. ChoicePoint caters to nearly all property and casualty insurers.

The ISO says the databases it maintains, called the All Claims databases, are strictly for detecting fraud and expediting the claims process. If the ISO sees a series of claims that looks suspicious - for example, the same name appears on all the claims with a different social security number - the company will notify the insurance company and the insurer will investigate. The ISO also has information about any of your claims that might have ended up in court.

Some insurers have their own "scores"

After investigation, State Farm - the country's largest auto insurer - decided to use "prior loss history and certain credit characteristics" to create a model that helps it determine an underwriting score for a policyholder applying for a homeowners or auto policy.

State Farm says, "It is significant that we are combining credit characteristics and prior claims history for these models and that we have developed the models using our own book of business. Our models are not designed to assess wealth, income, or creditworthiness, but focuses on the prediction of future insurance losses."

State Farm adds that it believes the "use of this model will lessen the extent to which those who represent higher potential risk are subsidized by those who represent lower potential risk."

Checking your records

Most of the information that insurance companies collect and use for rating purposes is available from government agencies credit-reporting companies. For example, you can get a copy of your motor vehicle report from your state's department of motor vehicles, and you can get your credit history from Equifax, Experian, or TransUnion.

You can get a copy of the ChoicePoint CLUE report by calling ChoicePoint's Consumer Disclosure Center at (770) 752-6000. The report will cost between $8 and $10, depending on how the consumer wants the information, says Wheeler of ChoicePoint.

You can acquire a copy of the ISO All Claims report if you dispute the information it contains. The ISO Auto Property Loss Underwriting Service (A-Plus) report provides insurance underwriters with the means to independently investigate and evaluate potential risks. Consumers can call (800) 709-8842 to obtain copy of their report. A "request for disclosure" form must be completed.

Who's Covered Under Rental Car Insurance?

Is it two for the price of one? Not always when it comes to rental car insurance. Finally going away on that long-awaited vacation? If you'll be renting a car and sharing driving duties with someone else, there are a few things you should know about rental car insurance before you go. Your own auto insurance

What and Who is Covered?

Auto insurance coverage varies from one insurer to another. Some policies may not cover rented vehicles at all. Many others will cover damage you cause to any car that you're driving, including a rental car. Your insurance may also protect you from liability claims up to the policy limits.

Even if your policy provides coverage, you need to know exactly who's covered. Are you and the other listed drivers on your policy the only ones covered while driving the rental car, or are other drivers covered, too? The only way to find out is to ask your insurance company or agent. If your fellow travelers are not covered, you might ask about coverage offered by the rental car company.

Note: Read your policy's fine print to see if any restrictions apply to the rental car coverage. For example, some policies may cover a rental car only when your own car is stolen or being repaired.

Credit card coverage

If you have a major credit card, the credit card company may provide some insurance coverage for your rental car itself (but typically no liability coverage). This coverage may be included in your account at no additional cost, or you may have to buy it separately. Check with your credit card company to find out what coverage you have and who's covered. In all likelihood, you (the cardholder) will be the only one covered while driving the rented vehicle.

Coverage from the rental car company

Rental car companies offer various types of loss waivers and insurance protection, usually for an additional cost. If you buy insurance from the rental car company, it may become your primary coverage. Be aware that you (as the renter of the vehicle) are generally the only one authorized by the company to drive the vehicle. This means that the company's insurance might not apply when other people are driving the vehicle. But there are a few exceptions:

In a few states, your legal spouse is considered an "authorized operator" of the vehicle and may drive it with your permission.

If you rent under a corporate account, your employer, employees, or fellow employees on a business rental may be considered "authorized operators" who can drive the vehicle with your permission.

You can add "additional authorized operators" who, if approved in writing, may drive the vehicle. Additional operators generally must be at least age 25 and have a valid license and a major credit card. An additional charge (e.g., $5 a day) may apply for each driver that you add.

These individuals are generally covered by any insurance you buy from the rental car company, but be sure to verify this with the company at the time you rent a vehicle.

Will Your Auto Insurance Come into Play If Your Child Gets into an Accident When Delivering Pizza?

Here's a PIZZADVICE for you about car insurance. If your child plans to use the family car on his or her part-time pizza delivery job, you'll need to check with your auto insurance provider to see if you'd be covered if your loved one were to get into a fender-bender in the line of duty. Insurance trade group officer Don Griffin is among the industry executives who would urge you to find out the answer to that before you hand over the keys to your teenager.

"If your child is delivering pizza as part of his part-time job and is driving your car for business then it's your personal auto insurance policy that's on the hook if there's an accident or some other incident that could result in a claim being filed," according to Don Griffin, vice president of personal lines for the Property Casualty Insurers Association of America, in Des Plaines, Ill.

Griffin's advice? "Notify your auto insurer in advance that you're going to let your child use the family car to deliver food as part of his or her part-time job. The insurer will probably charge you extra, but that'll be a small price to pay when considering that if you fail to notify your insurer in advance and your child gets into an accident driving the family vehicle on the job, you may get an unpleasant surprise of no coverage when you file a claim."

Ohio insurance agent Brad Vermilion said many insurers will shy away from covering your child using your family car for delivering pizza. "This type of job creates a lot of risk," points out Vermilion. Uncertainty about determining insurance pricing is a key reason why auto insurers aren't necessarily enamored by the idea of covering a vehicle used to deliver pizza.

"The car is driven to a lot of places at different times of the day and night, and it would be difficult for the insurer to be able to accurately price the risk," observes Vermilion. "You might have to shop around to find a company that would provide protection under that set of circumstances. That could entail purchasing a commercial auto policy, which would figure to be significantly more expensive than your private passenger automobile policy. But it'll definitely be worth the extra money. You'll have some peace of mind knowing that there will be insurance protection if junior gets in a fender-bender backing out of the driveway of one of his pizza delivery customers."

A cautionary message comes from Dave Snyder, vice president and assistant general counsel, of the American Insurance Association, in Washington, D.C. "Maybe," says Snyder when asked about whether your auto insurance policy would come into play in the pizza delivery scenario. "Check with your insurance agent or your insurance company about possible policy exclusions that would be applicable in this situation. There's no substitute for checking with people in the know regarding your personal insurance situation."

Your Car Has Been Stolen? Insurance Companies Offer Advice

In the unfortunate event that your car gets stolen, there is sage insurance advice being offered by Carolyn Gorman, vice president of the Insurance Information Institute (III), a nonprofit insurance information organization in New York, and Sam Sorich, president of the Association of California Insurance Companies (ACIC).

Gorman calls on drivers to be prepared in the event their car gets stolen. She suggests that "you'll have already taken proper steps to ensure you have suitable insurance as well as having obtained the information you'll need to contact the police department for filing reports and for notifying your insurance company to begin the claims process."

"Many consumers who shop for the lowest auto insurance rates fail to consider some inexpensive options that can save them a lot of money down the road," reveals Gorman, citing replacement rental car coverage as an example, pointing out that it costs "only a couple dollars a month." Under normal circumstances, renting a car for one day "can cost more than a full-year of auto rental coverage."

She notes that most insurance companies wait an average of two to four weeks if the stolen car is not found before authorizing the purchase of a new car, so the victim could end up paying as much as $1,000 to rent a car during the interim if they don't have rental car replacement coverage.

Gorman urges auto insurance customers "to review their policies once a year to make sure they will cover your needs if your vehicle is stolen or damaged in a crash."

ACIC's Sam Sorich notes that "insurers play a vital role in combating vehicle thefts. Insurance companies have staffs that are dedicated to investigating theft claims." Sorich calls on drivers to support insurance company efforts by taking simple but effective steps, notably securing their vehicles. "Lock your cars, install anti-theft devices, and leave nothing in the car that might attract thieves such as purses or wallets."

Tips to Prevent Car Theft

Worried about the possibility of your car being stolen? If so, the National Insurance Crime Bureau urges you to follow a "layered approach" to auto theft protection by employing the following steps:

Common Sense:

Deploy the cheapest, most basic form of defense … lock your car and take your keys.

Warning Device:

Use a visible or audible warning device/alarm system that can help ensure that your car remains where you left it.

Immobilizing Device:

Keep a would-be thief from staring or taking your car by using "kill" switches, fuel cut-offs, and smart keys. They are among the devices which are high and low tech, but extremely effective.

Tracking Device:

Consider the higher end of high tech tracking devices. These are among the newer devices available, and they can alert both you and law enforcement the moment an unauthorized user moves your vehicle.

Auto Insurance: The Protection You Need

On average, a motor vehicle crash occurs every 5 seconds, a person is injured in an accident every 11 seconds, and a fatal injury occurs every 12 minutes. Those are scary thoughts as you head out the door to school, work or to the store and convincing evidence of why auto insurance coverage is so necessary.

However, you can rest a little easier knowing that the crash fatality rate per 100 million vehicle miles traveled is the lowest it has been since record keeping began 30 years ago, registering at 1.46, and remained below 1.50 for the second consecutive year in a row.

According to the National Highway Traffic Safety Administration's (NHTSA) 2004 Early Edition Report, the number of police-reported motor vehicle crashes occurring on the highways dropped to under 6.2 million from more than 6.3 million in 2003, and persons injured in these crashes continues to steadily decline as well.

This reduction is due in part to the national campaigns aimed at increasing safety belt use and reducing impaired driving. Currently the seat belt law is mandated in all 50 states, which greatly helped reduce the number of persons killed in auto accidents in 2004. The countrywide campaign for drinking under the influence has also greatly helped reduce alcohol-related fatalities for the second consecutive year in a row.

Time plays a big part.

Even with all these new preventive measures, accidents are still happening. This is why the focus has turned to on which days and at what time accidents are occurring. According to the NHTSA, Saturday and Sundays nights between Midnight and 3 a.m. are the deadliest 3-hours on the road, with a total of 2,451 fatal crashes in 2004, seventy-six percent of these accidents involved alcohol.

So you now know what time of day to try and avoid, but do you know that time of year? The Early Edition Report indicates that August topped the charts with the most fatal crashes in one month and December had the most overall automobile accidents, totaling 601,000- something to keep in mind during your vacation and holiday travels!

Your car can affect your car accident.

The vehicle you drive can also play a large role in your car accident. Passenger cars and light trucks accounted for nearly 95 percent of the 11 million vehicles involved in motor vehicle crashes in 2004. Large trucks only accounted for 15 percent of the vehicle accidents. In addition, we saw an increase in vehicles rolling over during an accident. Of the vehicles that rolled over, utility vehicles presented the highest rate at 36.2 percent in fatal crashes, 9.6 percent in injury crashes and 2.4 in property-damage-only-crashes. Regardless of the crash severity, the majority of these accidents occurred during daylight, in normal weather conditions, while the vehicle was going straight.

Protect yourself with auto insurance.

Accidents do happen, but you can follow some simple safety measures while driving. These include wearing your seat belt at all times, obeying the speed limit, being cautious of your surroundings and having auto insurance. By having auto insurance, you are able to protect yourself, your family, passengers and other drivers from incurring additional heartache and financial burden.

Pay-Per-Mile Auto Insurance

With gas prices heading higher each year, many people are looking for resourceful ways to save on fuel, such as taking the bus, the train, riding a bike or car-pooling to work. Yet even with these money-saving tactics, drivers are still paying for full auto insurance coverage on their vehicles.

As we all know, there are some corners that just can't be cut. Or so we think! Many auto insurance companies are starting to consider a new insurance program that would offer consumers a discounted rate for reduced car usage. In fact, some insurance providers are already offering trial programs.

One big supporter of this new program is the Environmental Defense, anorganization currently promoting a Pay-As-You-Drive Insurance (PAYD) program to auto insurance companies throughout the United States. This innovative concept would link insurance policies to an odometer rather than just a renewal date on the calendar.

According to the Environmental Defense, PAYD would not only help save consumers money; it would also help reduce pollution. "PAYD provides financial incentive for driving less and is expected to reduce driving and congestion by 10 to12%", states an Environmental Defense official. "Driving less reduces air pollution, toxic runoff from roads, and impacts on climate."

PAYD would also make auto insurance more affordable for drivers by giving them more control of their auto insurance premiums - a change the National Organization of Women's Cents Per Mile group would be happy to see happen. According to NOW's website, low-income drivers often have to bear a higher insurance burden, unjustified by their lower mileage. This burden results in drivers dropping or not renewing their auto insurance policies. The new program will help to alleviate this problem, decreasing the number of non-insured drivers on the road while helping to reduce the financial strain on low-income and part-time drivers.

Exactly how does the PAYD program work?

Currently, there are two proposed techniques that could be used to detect car mileage usage. The first method involves installing a proprietary odometer that has an embedded cell phone that occasionally calls in your mileage to your insurance company. The other technique would entail installing a GPS device into an embedded phone, such as OnStar, to detail your actual routes.

Many groups object to this method because of the possible privacy infringement. However, the GPS device does have its advantages. Not only would it track your mileage, it would also detail where and when you drove. For instance, if you were traveling in a congested area during rush hour it might cost you more, as opposed to the savings you could potentially receive for driving during off-peak hours.

How much would it cost?

Auto insurance companies would convert a portion of your current annual rate into a per mile fee. Your auto insurance company would assign your car to one of its rate groups according to your zip code, type, and usage. Once your per mile rate is determined you will more than likely be asked to pay an upfront, set fee for your predetermined number of miles. Depending on how much you drive, you could either receive a rebate or pay more.

Testing the waters.

Currently there are two pilot programs underway in the United States. One program is through OnStar, who has joined with a national insurance company to offer a mileage discount program. Offered exclusively to motorists who own GM vehicles equipped with OnStar, this program will provide owners with the opportunity to earn an extra discount based on the miles they've driven. GM motorists have the potential to receive up to a 40% discount and save hundreds of dollars annually. Discounts are given to motorists who have driven less than 15,000 miles per year - the lower the vehicle mileage, the more significant the discount. Presently the program is only available in Arizona, Indiana, Illinois and Pennsylvania.

The other program, being offered in Minnesota, is designed for drivers that own a 1996 model year or older. This test study uses a matchbox-sized electronic device that is plugged into the owner's onboard diagnostics (ODBII) port. Once set up, the sensor detects how much, how fast and when the vehicle is in use. From there, the information is used to calculate the customers discount. This free, voluntary program can potentially save participants up to 25% on their car insurance…a considerable discount when you are trying to conserve funds.

Looking for ways to save on auto insurance, but don't have a PAYD pilot program in your state? Logon to Insurance.com's auto quote comparison tool. There, you'll be able to compare car insurance rates from up to 12 insurance providers, helping you save time and money on your auto insurance.

New Car Insurance Costs

More to the sticker price than meets the eye! Buying a new car can be a very exciting and overwhelming experience. Sorting through options, makes, models and features is enough to make your head spin. Not to mention the financing and car insurance costs. However, being prepared before you shop can help make the buying process quicker and easier for you!

Identifying the ideal car for you.

Before heading out to the car dealership, make a list of what you are looking for in a new car. As you are writing the list, think about the same concerns a car insurance company would consider when quoting you a rate, such as:

How do you use your car?

How many passengers do you typically carry?

How often do you drive your car?

Where do you drive?

These factors will help you pinpoint the best car for you, while also helping to potentially keep your car insurance premium down.

Features to consider before you buy.

Make a list of all the features and options that are important to you, such as head and leg room, transmission type, engine, trunk size, airbags, security system, anti-lock brakes and other safety features. Car insurance companies often give discounts for some of these items; saving you significant money on your overall quote.

Also, check out auto manufacture's websites. Many have special pages that let you "shop" for your dream car - giving you the opportunity to select the features that are important to you, while also providing you with the true cost of these "extra perks."

The cost.

Before you buy you should always factor in all costs involved with buying a new car, including sticker price, gas, maintenance, financing rates, taxes and car insurance.

How much you pay for your car has a powerful effect on your car insurance premium. A luxury car with all the latest safety features will typically cost more to insure than a no-frill economy car, due in part, because the higher-priced car may be more expensive to repair or is more likely to be stolen.

Yet some cars do consistently get better deals on car insurance rates than others. For example, a $14,000 Dodge Neon costs about the same amount to insure as a $34,000 Volvo XC70. According to Edmunds.com, the Dodge Neon would set you back an average of $4,410 in premiums over five years, while the Volvo would cost $4,605.

Why, you may ask?

The Volvo tends to receive a bigger insurance discount because it inflicts less damage to other cars in an accident, suffers less damage, has a lower theft rate and protects its passengers better in an accident.

According to one national insurance provider, the Dodge Neon does worse than the average car in all three categories, equaling the reason why it costs so much to insure.

Do your research!

Not only do you need to look at what your new car has to offer, you also need to do some background research as well.

Car insurance premiums are based partly on the price of the vehicle, which affects the replacement cost if it is stolen or "totaled" in an accident. How expensive the vehicle is to repair - including parts and labor - can also impact your insurance rate. In addition, surcharges may apply to vehicles that are frequently stolen or involved in accidents.

To find out if that next dream car might be more than you bargained for, visit Highway Loss Data Institute's website. Here you will find industry-wide information on injury claims, collision repair costs and theft rates by vehicle model.

Comparison shop before you buy.

Before you make your final decision, visit Insurance.com's auto quote comparison tool to find the best car insurance rate. There, you'll be able to compare car insurance rates from up to 12 insurance providers, helping you save time and money on your auto insurance.

Presently, Insurance.com offers consumers comparative car insurance quotes in every state except Massachusetts, Alaska and Hawaii.

8 Things You Should Know About Auto Insurance

Dealing with the ins and outs of auto insurance can be as tricky and confusing as trying to untie the Gordian knot. Although we can`t help you with the knotty Gordian problem, the following recommendations could help you figure out some of the more complicated points of auto insurance.

1) Determine appropriate coverage.

Help control the price you pay, just ask American Insurance Association executive Dave Snyder. For example, Snyder notes that half of your auto insurance bill covers liability and "that has to do with how you are going to use the vehicle, such as for commuting to work and your driving record. If you`ve got a clean driving record, you figure to pay less for insurance than you would if you had a speeding ticket on your record. You can control the other half of your premium which covers damage or loss to your vehicle, comprehensive and collision coverage."

2) Shop around for insurance.

"In most states," Snyder reports, "there are hundreds of insurers competing for business, so it`s possible to save hundreds of dollars by obtaining quotes from different auto insurance providers." Picking up on Snyder`s theme is his AIA colleague, Nicole Mahrt. Mahrt urges you to work with your insurance provider to get more than one quote. "It pays you to shop around, especially if you feel you`ve been paying too much."

3) Look for insurance discounts.

"Many insurers will give you a discount if you buy two or more types of insurance from them, for example auto and home insurance," confirms John Marchioni, senior vice president of Personal Lines for Selective Insurance, in Branchville, N.J. More cost-saving suggestions from Marchioni: "Ask about discounts for air bags, anti-lock brakes, daytime running lights and anti-theft devices."

4) Consider taking a higher deductible.

"You could lower your insurance bill by increasing your deductible," Mahrt says. "But just make sure you can pay the higher deductible if you file a claim."

5) Look into "stacking" coverages if you file an insurance claim.

Insurance trade group officer Daniel Kummer explains that stacking uninsured/underinsured motorist coverages means "you can collect from more than one of your auto insurance policies. Most states prohibit this practice, but there are about 19 states that either allow stacking or don't address the issue either through legislation or litigation," according to Kummer, director of personal insurance for the Property Casualty Insurers Association of America. "Be sure to check your auto insurance contract to see if it's allowed. "Be advised that you`ll likely pay a higher insurance premium if you have stacked coverage. "It could be 10% to 30% more depending on the litigious nature of the state in which you reside," says Kummer.

6) Check with your insurance provider BEFORE buying a car.

"Your premium is based in part on the car`s sticker price, the cost to repair it, its safety record and the likelihood of theft," answers Selective`s John Marchioni. Remember to avoid shopping by price alone. "You want an agent and a company that answer your questions and handle claims fairly and efficiently," emphasizes Marchioni, senior vice president of Personal Lines for Selective Insurance.

7) Notify your auto insurance company as soon as you change companies.

"Be sure to cancel your old policy," suggests PCI`s Dan Kummer. "Do it the same day, but don`t cancel your old policy until you`ve lined up a new contract. That`s important because some states like New York will fine you for the number of days you go without insurance." One last thought from Kummer on the subject: "Most auto insurers specify in your contract that you can terminate your policy any time you want by informing your company in writing about the date you wish that coverage be terminated or you can do that over the phone.

8) Pick the insurance payment option that best fits your budget.

"Generally, most companies will give you the ability to pay over time, but that comes at a price," says Kummer. "Your payment could increase a few dollars each time you pay by installment. Insurers can accept payments monthly, quarterly, or every six months, what ever is most convenient for you. Remember, though, that the more you break down your payments, the more the cost adds up."

Seat Belts Make Auto Safety a Snap

What auto device is simple to use, takes just a second to snap into place, and saves thousands of lives each year? Seat belts of course - probably the single most important tool you have to keep safe while driving.

Seat belt stats at a glanceAccidents do happen, and chances are you`ll be involved with one or more in your lifetime. In fact, according to information from the National Highway Traffic Safety Administration (NHTSA), more than 15,000 passenger vehicle occupants died in evening traffic crashes during 2005, and 59% of those occupants were not wearing seat belts at the time of the fatal crash. This is compared to the 44% of occupants who were not wearing seat belts and were killed during daytime hours in `05.

Sobering statistics, no doubt. The good news is the NHTSA reports 77% of passenger vehicle occupants who were in a serious crash and were wearing seat belts survived. Wearing seat belts has been proven to reduce the risk of fatal injury by 45% for front seat passenger car occupants and by 60% for those in pickup trucks, SUVs and mini-vans.

More good news: According to an `06 NHTSA report, seat belt use across the nation is pretty solid. The average rate was 81%, with seat belt use ranging from 63.5% in New Hampshire and Wyoming to 96.3% in Washington. And 11 states and territories have rates 90% or higher - including Washington, Michigan, Oregon, California, Puerto Rico, Hawaii, Nevada, Maryland, Texas, Georgia and New Jersey.

While these rates are high, the only truly acceptable seat belt usage rate is 100%, 24/7, for all drivers.

Seat belts save more than livesInterestingly, there`s a huge economic impact related to wearing seat belts. According to an '02 report by the NHTSA, between 1976 and 2002 seatbelts prevented 135,000 fatalities and 3.8 million injuries - saving an amazing $585 billion in medical and related costs. Their report states if everyone had used seat belts during this period, nearly 315,000 deaths and 5.2 million injuries could have been prevented, saving roughly $913 billion.

That's an incredible amount of savings and potential for more savings during a time when many driving-related costs can be high - from gasoline to insurance premiums.

Click It or Ticket in actionThis year from May 21 until Memorial Day (May 28), the NHTSA is encouraging law enforcement agencies nationwide to take part in the Click It or Ticket campaign, aimed at enforcing seat belt use. Jurisdictions with stronger seat belt laws generally show higher seat belt usage rates than those with weaker laws. A good example is Mississippi, where the seat belt law was changed to a "primary" enforcement law in 2006 and seat belt use jumped from 60.8% to 73.6%.

The NHTSA hopes the Click It or Ticket campaign encourages drivers to consider the legal consequences of not wearing a seat belt, in addition to being aware of the enormous safety benefits seat belt use brings.

Quick tips on proper seat belt use and safetyJust a few quick reminders about the right way to wear your seat belt: First, the belt should be low and snug across the pelvis or lap, and never across the stomach.

The shoulder belt should be across the chest and collarbone, and be snug. It should never be in front of the face or behind the back. Remember, you still need to wear seat belts even if your car has air bags - in fact, air bags only work properly if you are belted in and they are not designed to replace seat belts.

All children under 12 should be buckled into an appropriate seat, such as a child safety seat in the back. To find out the best child safety seat for your child's weight and age, check with your local children's hospital. Newborns should be placed in rear-facing car seats in the back.

Wearing seat belts is a snap, saves lives daily, and saves billions of dollars. So keep in mind the link between car accidents and seat belts when you take to the roads. We'll all be safer for it.

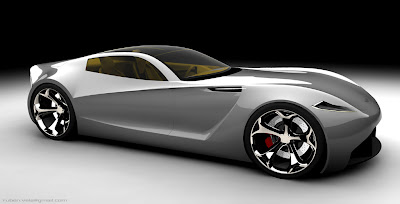

Super car :The Aston Martin DB-ONE

When the time comes, Aston Martin should give this guy a call. Ruben Vela is a Spanish designer who just received his Masters Degree in Automotive Design last year from Polytechnic University in Valencia. He created the DB-ONE Concept you see above (and in the high-res gallery below). Vela says that the design's most important element is "dynamism", kind of a subtle tension between the car's surfaces and lines that gives it an energy even when static. The front grille is much larger than current Aston models and becomes the focal point of the DB-ONE's front end, while the narrow slit headlights ensure that the massive expanse of sheetmetal presents a dominant front end. A true two-seater, the DB-ONE's windshield extends up and over the cockpit to let the sun shine in, as well. The extremely tapered rear is probably the least production feasible element on the car, though it definitely adds to the "static motion" theme.

Bertone headed to U.S. with BMW-powered sportscar?

Of course, the interesting news that caught everyone's eye is this short paragraph at the end of the article that reveals Bertone told its workers it hopes to preserve 300 jobs by producing up to 400 units of a camper van and a BMW-powered sports car for the U.S. market. Automotive News asked BMW about the proposed model, and heard back that the Bavarian boys and girls club was not involved in the car's development, though BMW didn't deny its existence.

Bertone did show a 95th Anniversary Concept at the Geneva Motor Show in March that is based on the Fiat Panda 100HP. This two-seat roadster concept could foreshadow the model referred to in the AN article.

Buick getting fourth model, Velite likely

In an interview with Car and Driver, Troy Clarke, president of GM's North American efforts, confirmed that Buick would be getting another model by the end of the decade. The forth vehicle to join the Buick stable will be rear-wheel drive and take cues from the Velite concept that debuted at the 2004 New York Auto Show.

Whether or not such a vehicle will be a convertible or a large sedan remains to be seen, but it will share the Zeta platform underpinning the upcoming Pontiac G8 and Chevrolet Camaro. The Velite name may not carry over.

In the same article, Clarke espoused Pontiac's goal of being a performance-oriented brand, while at the same time suggesting that all of Pontiac's products will not sport RWD. Clarke confirmed that a redesign of the FWD Vibe is in the works, and may be released as early as this year.

BMW Z6 leads off growing Z-series

The BMW Z8 might have tanked a bit, but BMW isn't phased... much. The replacement is the BMW Z6, which BMW will pit against the Mercedes' SL class. The car will be produced in a higher volume at a lower price than the $130,000 Z8, and accompanied by two other Z-series vehicles, the entry level BMW Z2 and successor to the BMW Z4. The Z6 will use the BMW 5- and 6-series as a basis and sport "space-age" construction utilitizing such materials as aluminum and sport engines ranging from the twin-turbocharged 3.0 V6 to a "beefed-up" version of the 5.0L V10 found in the M5.

[Source: AutoWeek]

Imports dominate retained-value Top 10... with one exception

We missed it early this month, but the new Power Information Network retained value rankings for the automakers came out, and while the top ten list is pretty much owned by imports, HUMMER crashes the party, coming in at the #8 spot. HUMMER vehicles retain 63% of their original value, an increase of 3.5% over their last showing. Scion sits in the top spot, retaining 69.8%

Toyota (Scion #1, Toyota #5, Lexus #6), Honda (Honda #2, Acura #4) and BMW (MINI #3, BMW #10) actually account for seven of the top ten, with Subaru (7th) and Nissan (9th) rounding out the list along with HUMMER. While domestics remain largely absent from the overall top 10 list this year, they make a strong showing in the top 10 most improved marques in terms of retained value, taking seven of those spots. Click the read link to see the full lists and related statistical information.

Loremo working prototype debuting in Frankfurt

It certainly looks cool, but even fuel mileage in the realm of 117 mpg may not be enough to convince buyers that the nearly totally impractical configuration is worth it. Seriously, a car you have to shimmy over the fender to get into? Think of how much fun that'd be in the winter, especially if you wanted to keep your pant leg clean. Do the Limbo Rock! The concept has nice lines, looking like an update of one of those "car of the future" flights of fancy from the 1950's. Fitting right into that theme is the tilt-away windscreen and controls - again more fun for inclement weather.

Well, that was cathartic. The real news here is that a roadworthy prototype will hit the stand this September in Frankfurt. Details between the showgoing car and actual production models may vary slightly, but the show car will be a very close approximation of what Loremo hopes to offer for sale. One thing that's definitely going to come in for adjustment are the fuel consumption figures. The 117 mpg figure was realized with a computer simulation, so we'd expect that number to change as the prototype goes about proving out all the theory. In addition to the motor show circuit, Loremo will be competing for the California X-Prize in hopes of securing further development funding.

Amazing! Maserati Quattroporte Sport GT Saloon to Frankfurt Motor Show 2007

Maserati is planning to unveil a new version of its Quattroporte saloon at next month's 2007 Frankfurt Motor Show, with the new car carrying the title 'Sport GT S.'

Based on the current Sport GT, the new 'S' nomenclature sees the car receive a host of upgrades including the latest in Brembo braking technology and new single rate dampers and stiffer springs instead of the existing Skyhook electronic suspension system.

The new set-up sees the car sit 10mm lower at the front and 25mm lower at the back, giving it more of a race feel.

The new brakes of Maserati Quattroporte Sport GT feature a dual cast design, blending both cast iron and aluminum. This technology helps to reduce brake fade and improving the overall feel without the squeaking associated with carbon ceramic brakes.

The Maserati Quattroporte Sport GT exterior has been pumped up with a black chrome mesh grill and black chrome 20in seven spoke alloy wheels shod with Pirelli rubber. The only transmission option is the same ZF six-speed auto that appears in the standard auto model.

2007 Toyota Kluger First Drive

Ford's segment-leading Territory is about to face its greatest adversary yet - a new Toyota Kluger that is not only better than its predecessor but this time also available in 2WD guise. By JEZ SPINKS.

If copying is the sincerest form of flattery, then the Ford Territory right now must be blushing bright pink.

Less than a week afterHyundai launched a two-wheel-drive version of its Santa Fe '4WD', Toyota has just introduced its second-generation Kluger that's also available in either 2WD (driving the front wheels) or 4WD configurations.

Ford's Territory has ruled the mid-sized-SUV roost since it launched in 2004, comprehensively outselling rivals that included the original Toyota Kluger thanks to the popularity of Australia's first two-wheel-drive SUV (sport utility vehicle).

Toyotatook note of 2WD Territorys accounting for about 60 per cent of the model's overall sales.

So it's here on the roads around the Brisbane Ranges National Park, Victoria, that we find ourselves driving a mid-spec (KX-S) Kluger '4WD' that sends its power to the front wheels only. The Kluger range also includes entry-level (KX-R) and flagship (Grande) trim levels, for both 2WD or 4WD models.

It looks identical to a four-wheel-drive Kluger, with only the absence of an 'AWD' badge on the tailgate giving the game away. The new Kluger is relatively bold in Toyota terms, and the styling is a marked visual improvement over the bland and dowdy original.

A slight tugging on the steering wheel under initial acceleration confirms power is being sent solely to the turning wheels, though it's undramatic. The unnatural feel of electric assistance is also noticeable around the straight-ahead but the steering becomes more linear once turning, if imparting little feedback from the front tyres.

And it takes only a few corners to notice that even if this second generation Kluger doesn't corner as confidently or as enjoybably as Ford's relatively agile and alert Territory, Toyota's new mid-size high-riding wagon benefits from being based on the same platform as the much improved, sixth-generation Camry that went on sale in 2006. (The original Kluger was based on the previous-generation Camry platform.)

A larger footprint (the wheels spaced further apart) helps to improve the Kluger's roadholding.

Compared with the original Kluger, the new model increases its wheelbase by 75mm to 2790mm, and front and rear tracks stretch by 55mm (to 1630mm) and 90mm (to 1645mm) respectively. (Rear track is 5mm narrower on 4WD versions.)

The 2007 Toyota Kluger's suspension set-up also benefits from local tuning despite being imported from Japan rather than being built locally like the Camry.

The ride has an underlying firmness but was generally compliant on the roads west of Melbourne. One niggle was that on one particular stretch of wavy bitumen, travelling at 100km/h, the dampers allowed a bigger upward motion than preferable, although the suspension never became bouncy.

If there was a stand-out feature of the original Kluger, it was its strong and smooth 3.3-litre V6. The new Kluger uses the updated 3.5-litre V6 that does service in the Aurion, Tarago, and Lexus RX350, and it ensures Toyota's mid-size off-road wagon once again has a refined engine at its heart.

The new Kluger's peak power and torque are delivered at exactly the same revs as in the aforementioned models - 6200rpm and 4700rpm respectively.

Despite having to propel at least 200 kilograms more than the Aurion, the V6 remains smooth and linear in the Kluger. It combines well with the smooth-shifting five-speed automatic gearbox to ensure the Kluger is no slouch either from a standstill or when overtaking.

Keen drivers will appreciate the transmission's pseudo-manual mode, which will hold selected gears to the rev limiter.

Toyota claims a 0-100km/h sprint time of 8.0 seconds for the front-drive Kluger (two-tenths quicker than the 4WD version), and the launch drive suggested the Kluger has the potential for class-leading performance.

A comparison test will also confirm whether the new Kluger offers the most spacious cabin in the segment.

First impressions are that there's generous legroom for second-row passengers and acceptable space for limbs in the third row (where fitted). If all occupants are adults, however, the Kluger is more effective as a six- rather than seven-seater.

The middle seat of the second row is best suited for a child, or alternatively this seat can be pulled out and stowed in a compartment accessed in the back of the centre console.

A 'mini console' storage tray clips into the vacant middle spot, effectively turning the outer second-row seats into individual 'captain's chairs'.

The third-row seats are easily stowed from an upright position, using pull-straps. Tugging the first pull-strap flips forward and down the two headrests; straps for each seat flattens them into recesses so they create a flat cargo floor.

And no less than 10 cupholders are dotted around an interior that is much improved in design - particularly the dash - and quality over the original Kluger.

The seats provided good comfort on the two-hour launch drive, and a tilt and reach adjust steering wheel ensures a good driving position.

For buyers who genuinely want to take their Klugers off-road, a short test drive of a 4WD version revealed the new Toyota is capable of tackling more than just dust trails.

The 4WD Kluger proved it could tackle a good variety of terrain, progressing through an off-road course that comprised rocky dirt trails, muddy inclines, cambered rock trails, water crossings, and steep, slippery descents. Both the Kluger's electronic uphill and downhill assist functions were effective during the course.

The second-generation Toyota Kluger is another spectacularly competent Toyota. It's enough to turn the Territory green - and not just with envy

Toyota Verso Review

The competent Toyota Verso is only let down by its cramped rear seats and high prices.

Driving

The Toyota Verso is available with a 1.8-litre petrol engine, but it's the two Lexus-derived diesels that impress most. The 2.2-litre motor is offered with two power outputs (138bhp and 189bhp), and is refined, smooth and never becomes strained - even under hard acceleration.

The Toyota Verso feels urgent in diesel guise, with strong pace in all gears other than sixth. What's more, it's capable in corners, with good body control and plenty of grip.

Like most MPVs, steering feedback is limited, yet it's well weighted. If we were being picky, we could wish for more involvement, yet the Verso nevertheless inspired confidence, particularly at speed.

Marketplace

The Toyota Verso was designed with European buyers in mind, and that's clearly evident in the styling. A high waistline and small glass area give it a car-like look, while the smoothly raked bonnet and windscreen camouflage the MPV styling well.

A name change in 2007 dropped the old 'Corolla' tag (the two were never mechanically related, anyway) and introduced a restyled front bumper, grill, headlamps and rear clusters. This brought it in line with the 'family' look sported by the Auris and Yaris.

The seven-seat model offers an inclusive range, including a value-led SR variant, and competes with the RenaultScenic, Vauxhall Zafira, Mazda 5 and HondaFR-V.

Owning

The Toyota Verso isn't the longest compact MPV in its sector, but the wheelbase is ample, so it tries to make best use of its dimensions. However, there are compromises.

The boot is small and overall load space with the seats folded isn't the best. The third row of chairs is cramped and headroom is severely restricted - anyone over six feet tall won't actually fit in. What's more, the seats aren't very comfortable.

Worse still, the triangular-shaped windows are small and let in minimal light, so the Verso feels claustrophobic.

At least it's effortlessly easy to raise and lower the rearmost chairs. But things improve as you move forward. The middle row of seats is impressively comfortable, and each of the three chairs slides and folds flat individually, giving plenty of flexibility. Leg and headroom are good, while the outer seats slide forward and tilt in one action.

We weren't impressed with the strap pulls to fold the seats, however - they are difficult to grip, although again the chairs are a breeze to drop and raise.

Only a single pull is required to lift the seatback, while the base slides neatly into position. In addition, the driving environment is a very pleasant place to spent time. There's a good range of seat and steering wheel adjustment and on longer journeys the Toyota is good for tall drivers thanks to its car-like driving position. The centre console features stylish green back-lit details, and material quality impresses.

Everything is solidly put together and elements such as the switchgear have a solid feel. All this doesn't come cheap, however, even in 2007-on facelift form. But the Toyota compensates with strong residuals and goodfuel economy.

Blog Archive

-

▼

2007

(51)

-

▼

November

(51)

- What Your Auto Insurer Knows About You

- 10 Tips to Avoid Auto Accidents

- Car Safety Tips for the Holiday Shopping Season

- Car Safety: Side Impact Crash Test Results

- Study Shows Cell Phone Users More Prone to Accidents

- Insuring a Teen Driver in Single-Parent Households

- Tips for First Time Insurance Buyers

- Auto Insurance Rates On The Rise

- Does Your Occupation Affect Your Auto Insurance Rate?